- #SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED ANDROID#

- #SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED TRIAL#

- #SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED FREE#

Working for yourself brings with it plenty of freedom you decide when your day begins and when it ends. Terms, conditions, pricing, features, service and support are subject to change without notice.Professional content writer and branding aficionado Annie Button shares some valuable self-accounting tips for freelancers.Ī report from Upwork shows that freelance workers contributed $1.3 trillion to the US economy in annual earnings, which were up by $100 million from 2020. 37% more deductions by logging miles claim based on TY19 QBSE US subscribers that have identified >$0K in income and >$0 in business expenses Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control.ġ. Not all features are available on the mobile apps and mobile browser.

Devices sold separately data plan required.

#SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED ANDROID#

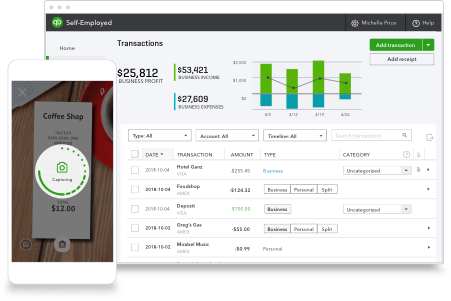

Mobile apps : The QuickBooks Self-Employed mobile companion apps works with iPhone, iPad, and Android phones and tablets. QuickBooks Online Payroll is not available with QuickBooks Self-Employed. Subscriptions will be charged to your credit card through your account.

System Requirements : QuickBooks Self-Employed, Self-Employed Tax Bundle, and Self-Employed Live Tax bundle require a persistent internet connection (a high-speed connection is recommended) and a computer with a supported Internet browser or a mobile phone with a supported operating system (see System Requirements).

You will not receive a pro-rated refund your access and subscription benefits will continue for the remainder of the billing period. Your cancellation will become effective at the end of the monthly billing period.

#SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED FREE#

You're free to switch plans or cancel any time. QuickBooks Self-Employed Cancellation Policy : There’s no contract or commitment. Each additional TurboTax Live Self-Employed federal tax filing is $199.99 and includes live on screen tax advice from a CPA or EA, and state tax filing is $44.99.ĬPAs when you need to talk : 100% of TurboTax Live experts are CPAs, EAs, or Tax Attorneys. Each additional TurboTax Self-Employed federal tax filing is $119.99 and state tax filing is $44.99. Sales tax may be applied where applicable.īundle includes the cost for only one state and one federal tax filing.

#SIMPLE ACCOUNTING SOFTWARE FOR SELF EMPLOYED TRIAL#

Offer valid for a limited time only and cannot be combined with a free trial or any other Intuit offer. To be eligible for this offer you must be a new QuickBooks Self-Employed and new TurboTax Self-Employed customer and sign up for the monthly plan using the “Buy Now” button. Your account will automatically be charged on a monthly basis until you cancel. Self-Employed Live Tax Bundle : Discount available for the monthly price of Self-Employed Live Tax Bundle (“Live Bundle”) is for the first 3 months of the subscription starting from date of enrollment. Sales tax may be applied where applicable. To be eligible for this offer you must be a new QuickBooks Self-Employed customer and sign up for the monthly plan using the “Buy now” button. Self-Employed Tax Bundle : Discount available for the monthly price of QuickBooks Self-Employed Tax Bundle (“Bundle”) is for the first 3 months of service starting from date of enrollment, followed by the then-current fee for the service. To be eligible for this offer you must be a new QBSE customer and sign up for the monthly plan using the ‘Buy Now’ button. QuickBooks Self-Employed : Discount available for the monthly price of QuickBooks Self-Employed (“QBSE”) is for the first 3 months of service starting from date of enrollment, followed by the then-current fee for the service.

0 kommentar(er)

0 kommentar(er)